Your document may be called Form 1095A, 1095B, or 1095C, depending on what type of health insurance you had last yearUpdated on January , 21 1030am by, TaxBandits For the calendar year , the IRS has updated Form 1095C with few changes It includes the introduction of new codes and lines for reporting Individual Coverage HRAsKeep in mind that this new form should be used only forMar 23, 21 · Here's a summary of the form series With the passing of the Affordable Care Act, three new tax forms came into the scene Form 1095 A, B, and C These tax forms were used to report your healthcare coverage during a tax year But, in 19, the healthcare penalty went away

Your 1095 C Tax Form For Human Resources

1095-c tax form turbotax

1095-c tax form turbotax-Similar to last year, you will be receiving a 1095C form per the Affordable Care Act This form provides verification that you and your dependents had coverage in You will not be required to file this with your tax returns but you will need to retain the form in your recordsJun 05, 19 · You can report the COBRA payments as medial expenses In , the IRS allows all taxpayers to deduct their total qualified unreimbursed medical care expenses that exceed 75% of their adjusted gross income if the taxpayer uses IRS Schedule A to itemize their deductions When you enter your expenses, TurboTax will do the math and let you know whether the standard or

Affordable Care Act Update New Information About Form 1095 B 1095 C Tax Pro Center Intuit

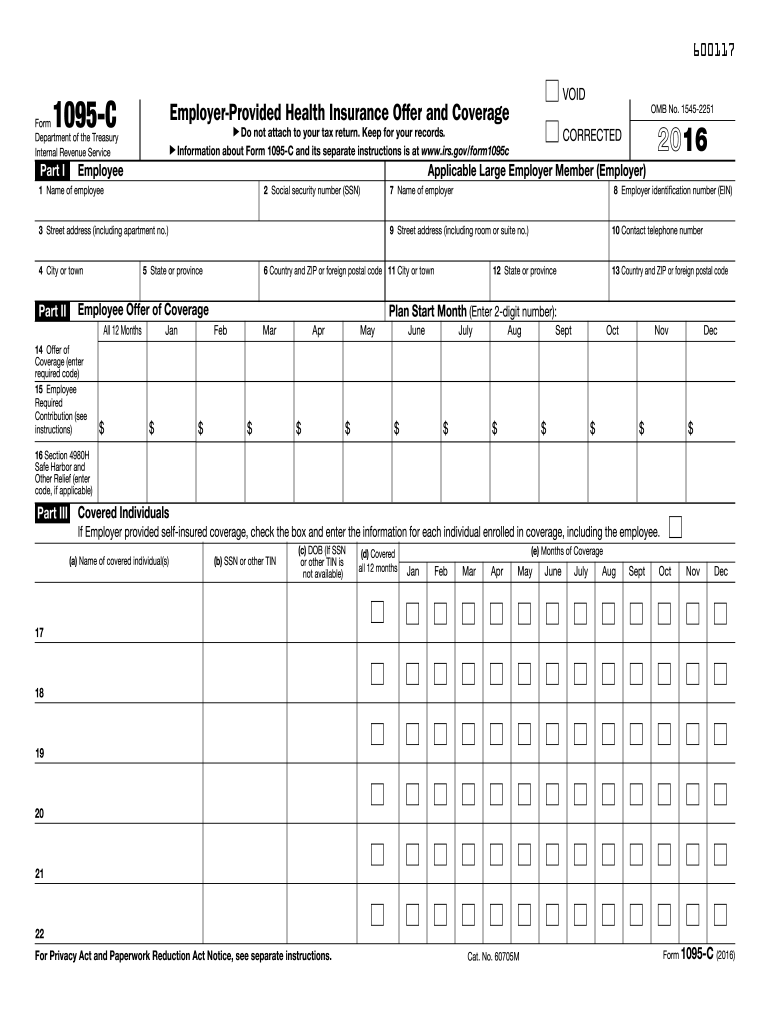

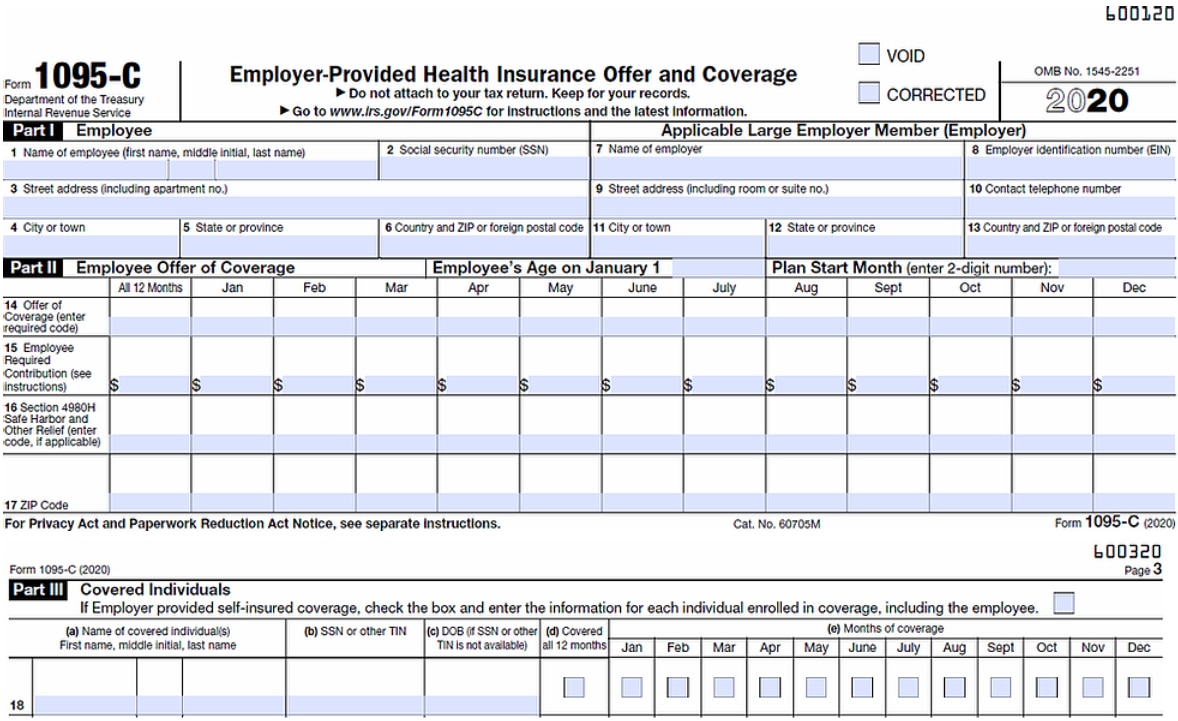

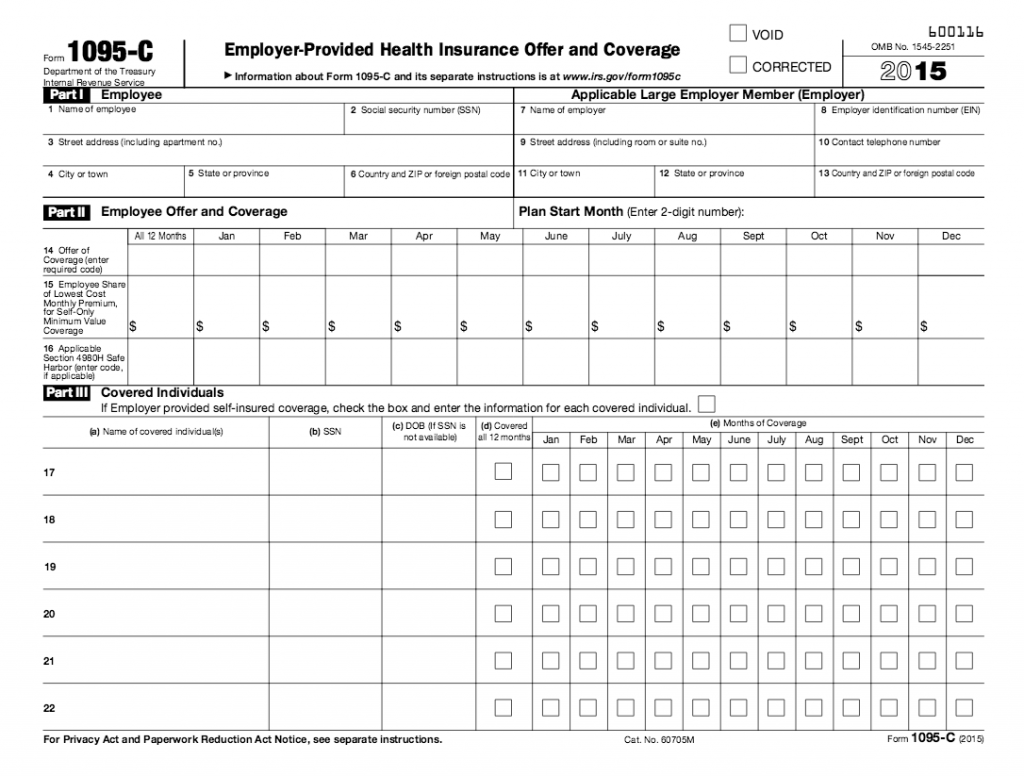

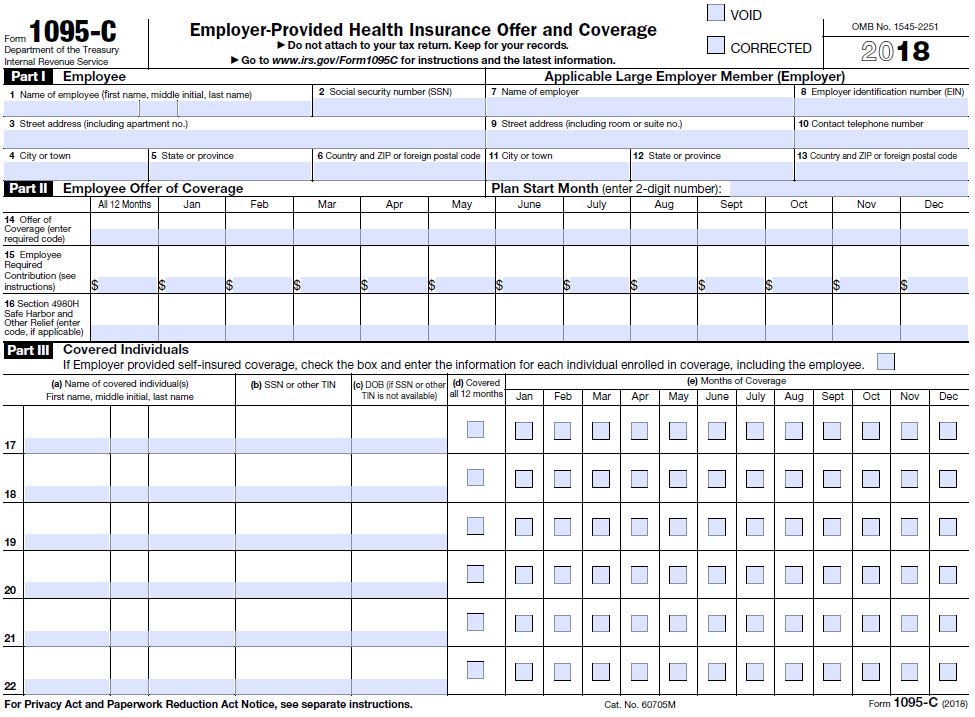

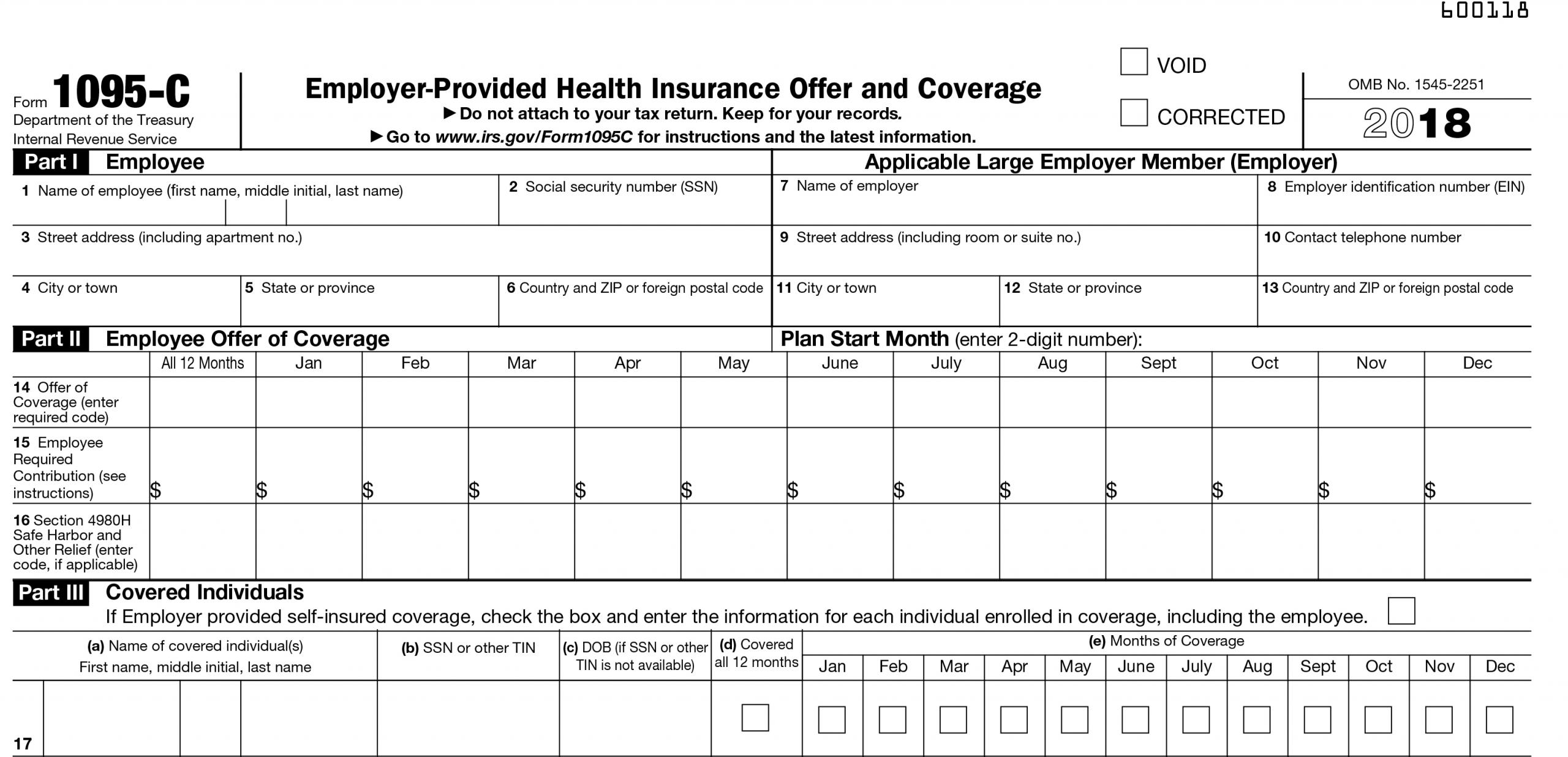

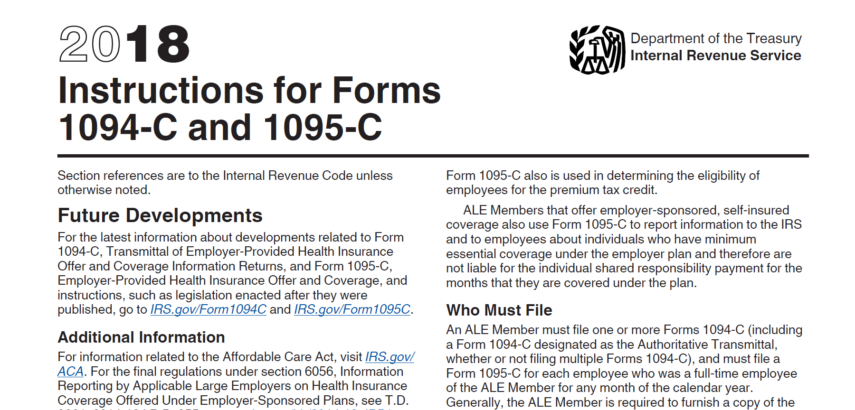

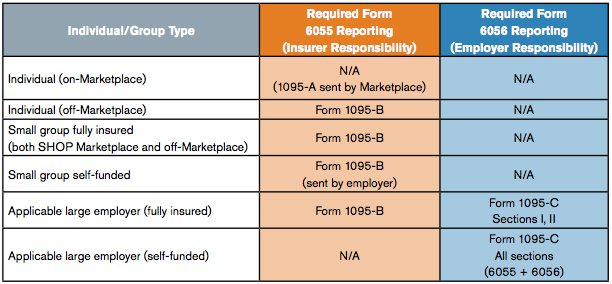

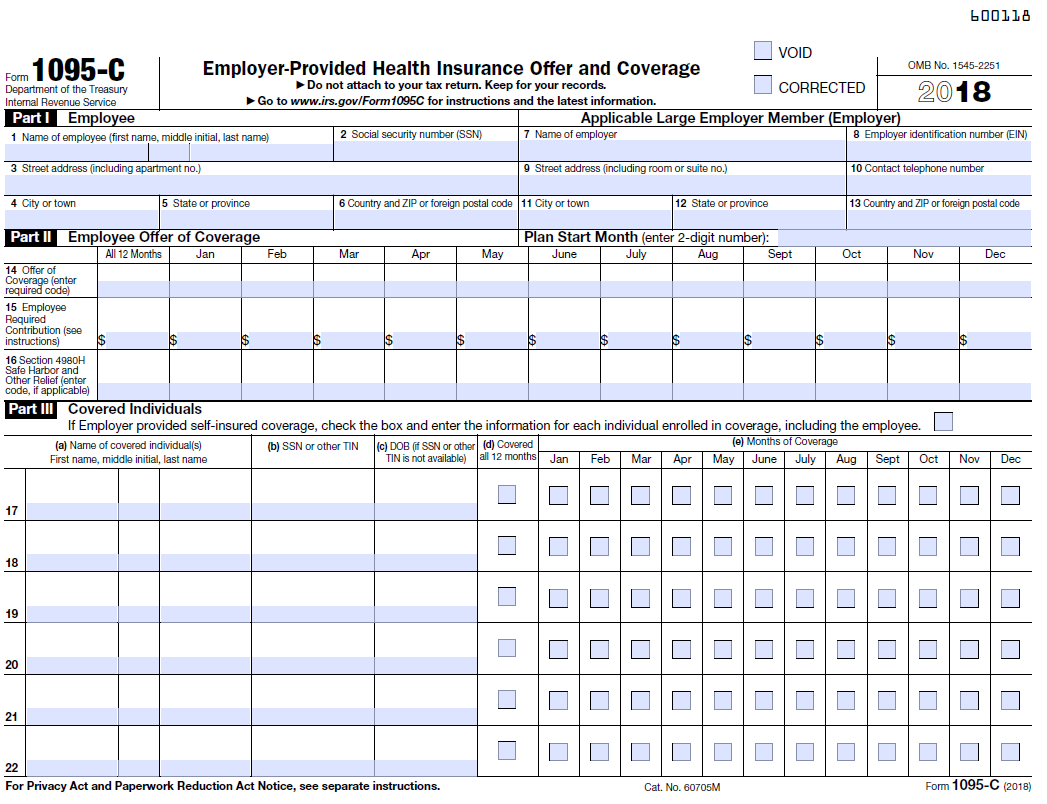

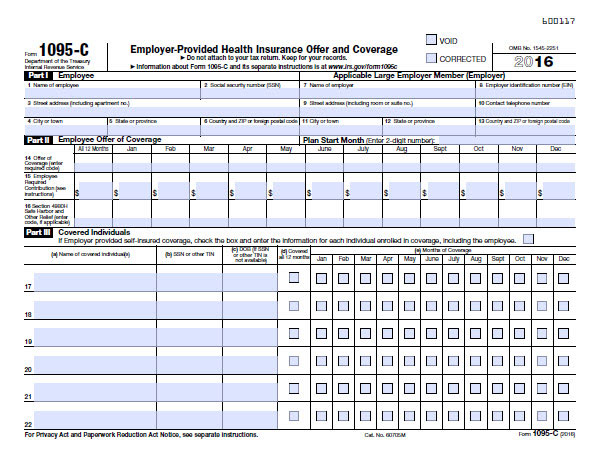

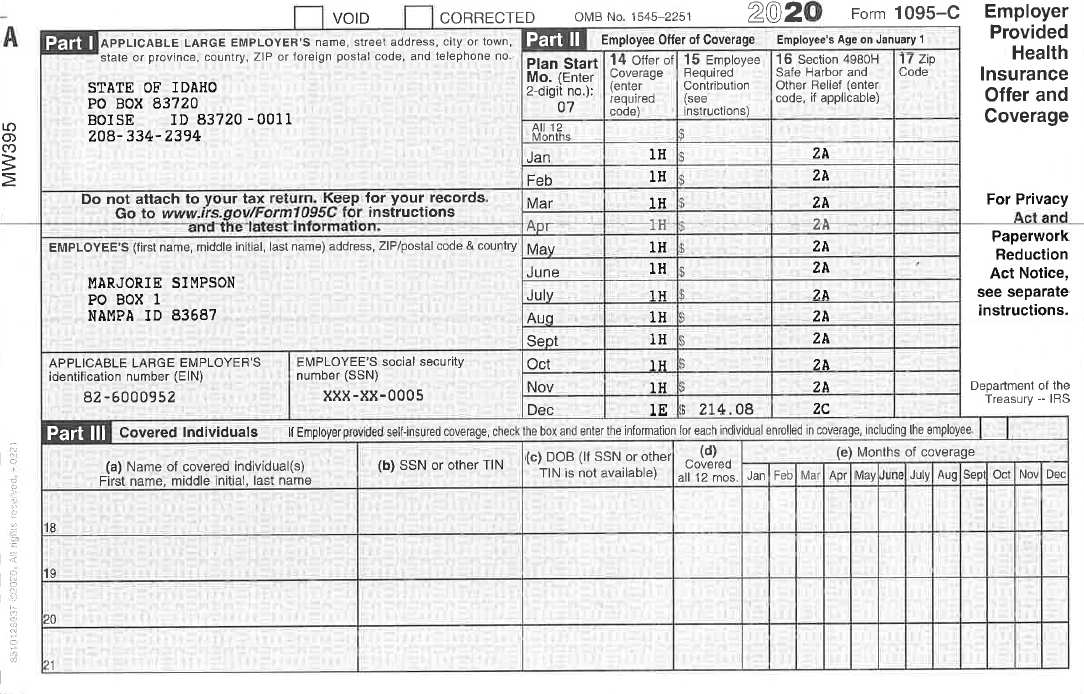

For the tax years when the Shared Responsibility was in in effect (1418), the Form 1095C was used to assist the preparer in the entries to the Coverage Exemptions on Form 65 and determine when the cost of Employer provided coverage is deemed unaffordable The Taxpayer is not required to have Form 1095C to complete the tax returnNov 06, · Form 1095C is a tax form reporting information about an employee's health coverage offered by an Applicable Large Employer The taxpayer does not fill out the form and does not file it with a tax return You only need to keep it forUnlike the IRS, NJ only accepts electronic 1095C submissions in the XML format Can I upload a test file before uploading the actual data to NJ MFT Secure Transport

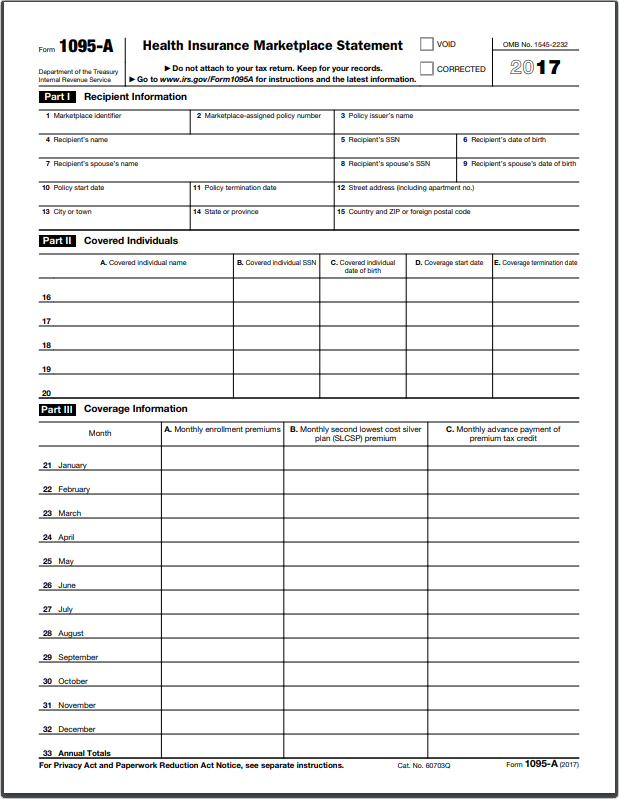

The Internal Revenue Service usually releases income tax forms for the current tax year between October and January, although changes to some forms can come even later We last updated Federal Form 1095C from the Internal Revenue Service in January 21A figure called "second lowest cost Silver plan" (SLCSP) You'll use information from your 1095A to fill out Form 62, Premium Tax Credit (PDF, 110 KB) This is how you'll "reconcile" — find out if there's any difference between the premium tax credit you used and the amount you qualify forForm 1095C What is Form 1095C?

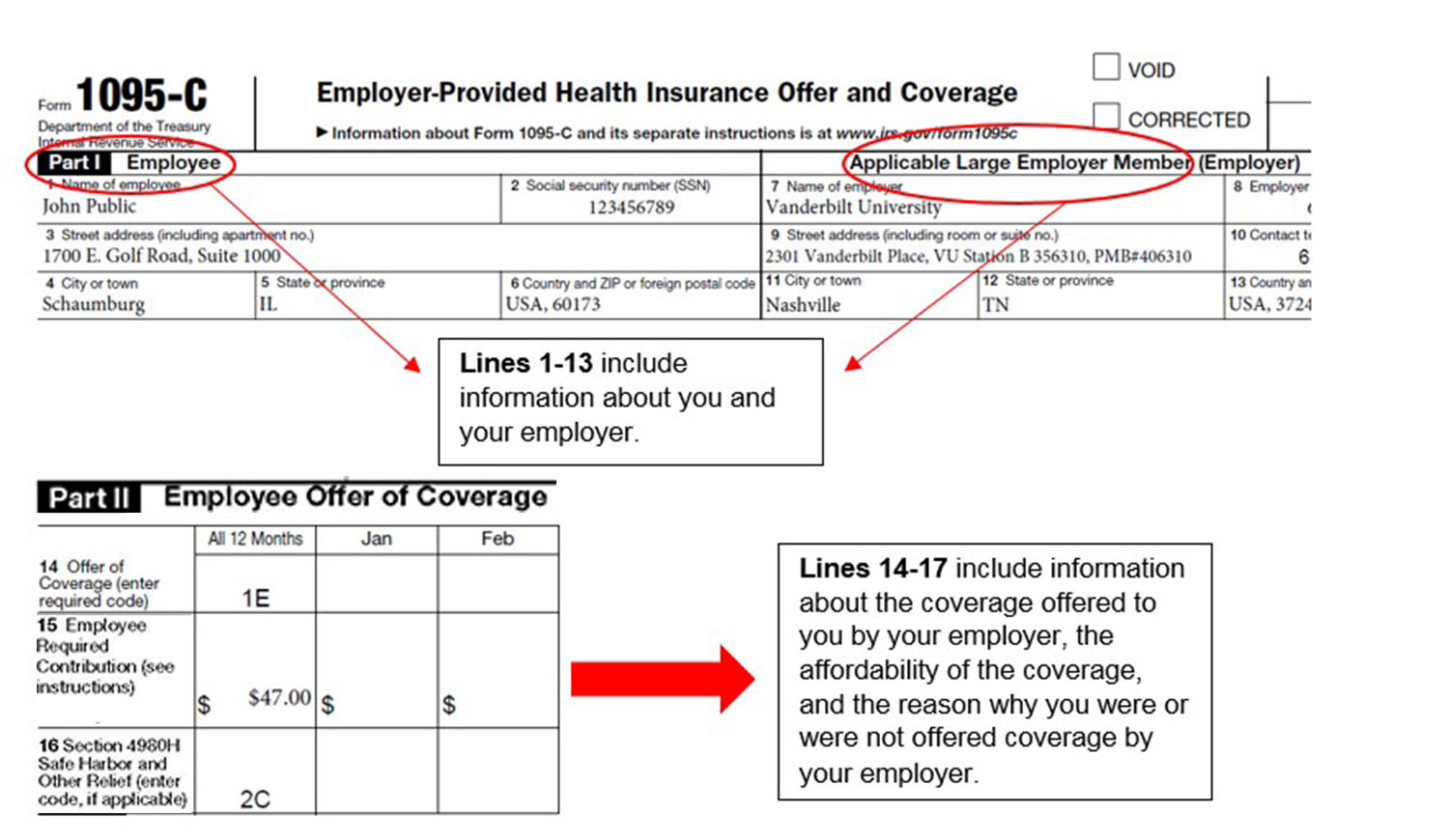

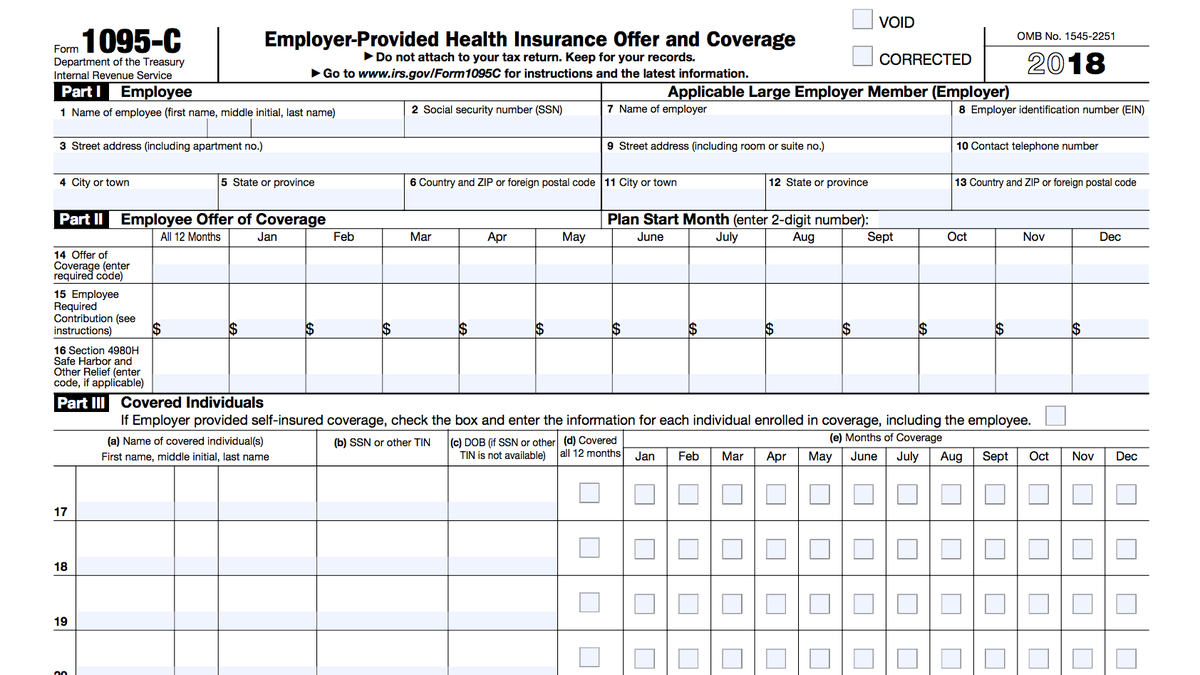

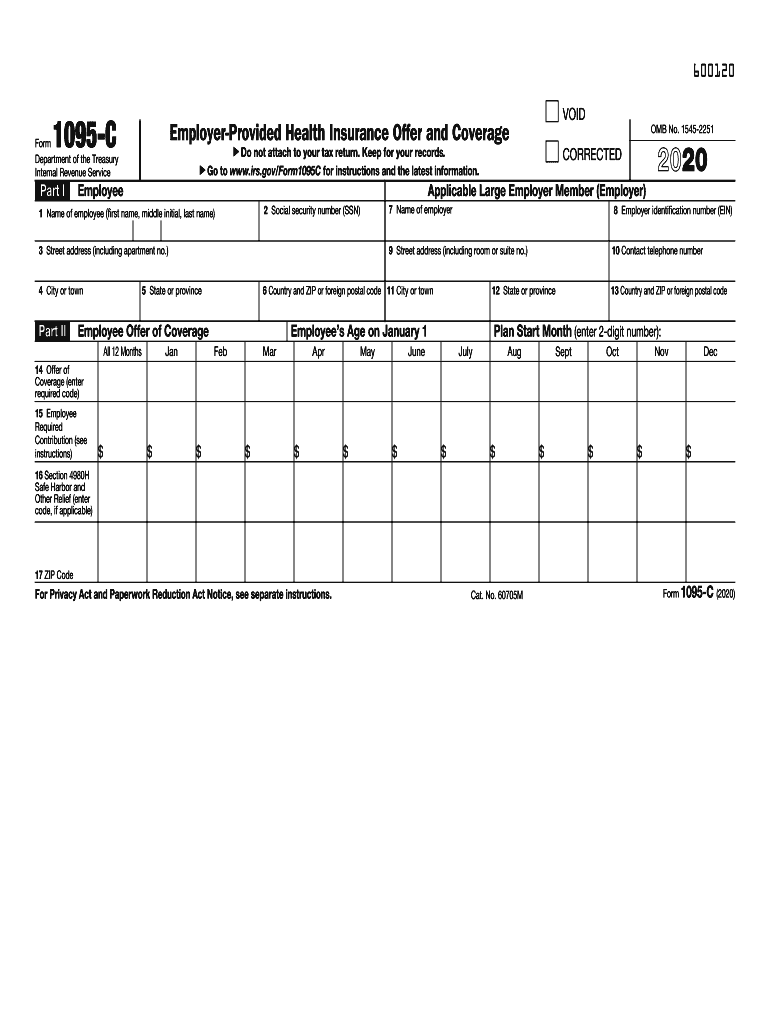

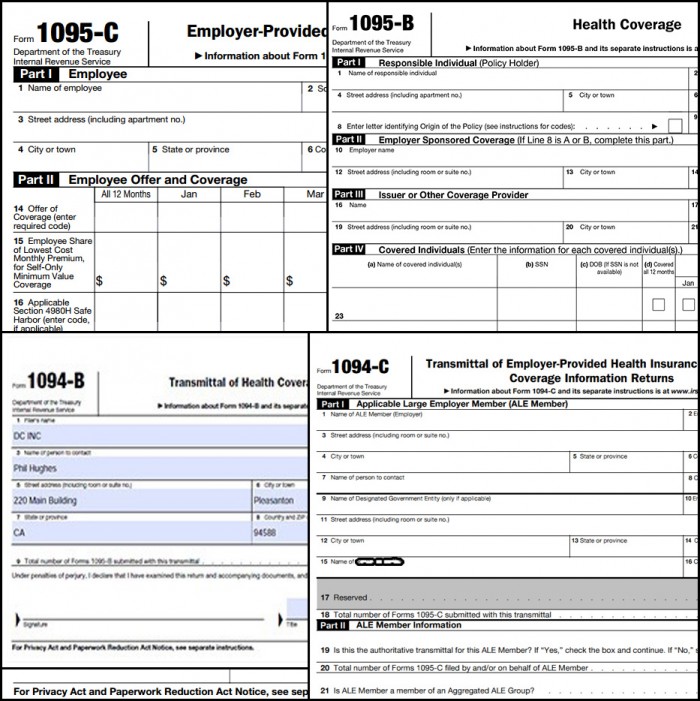

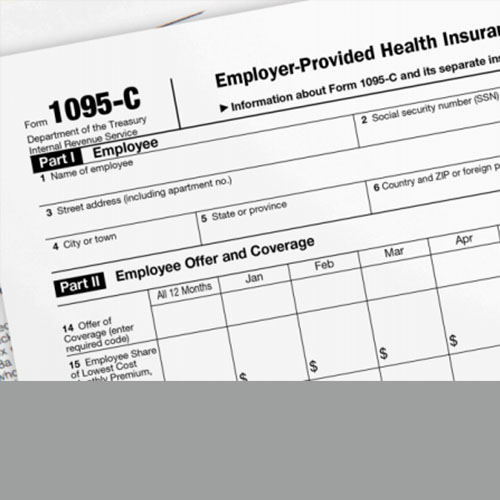

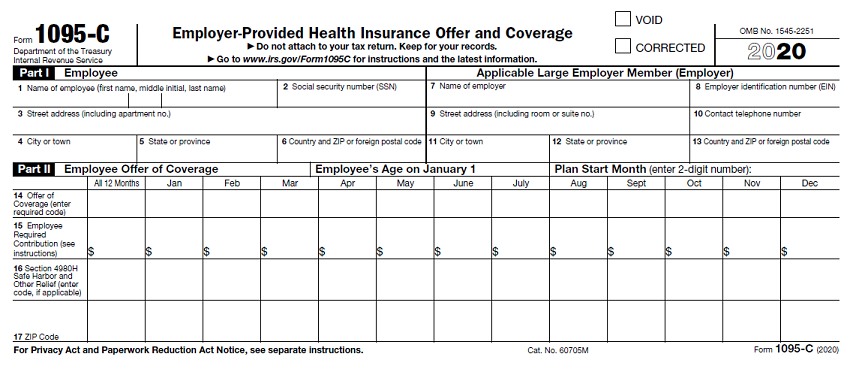

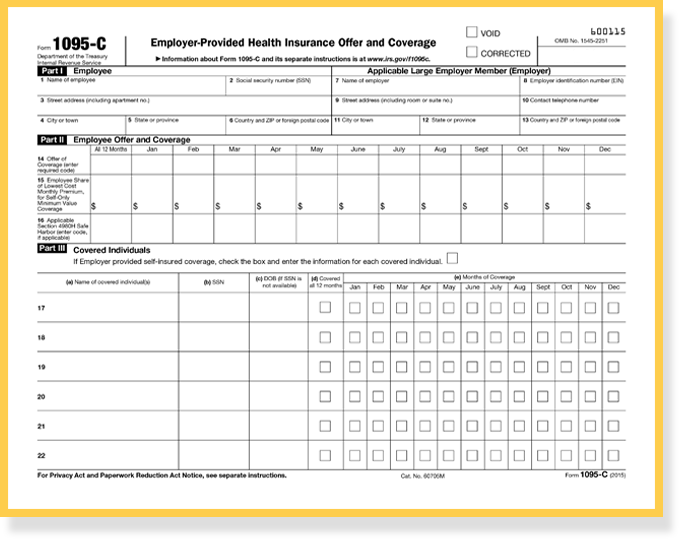

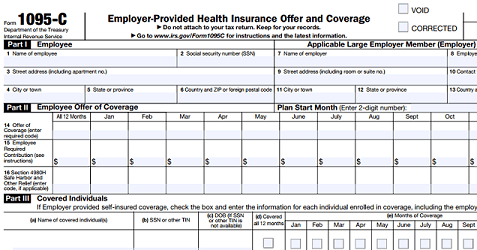

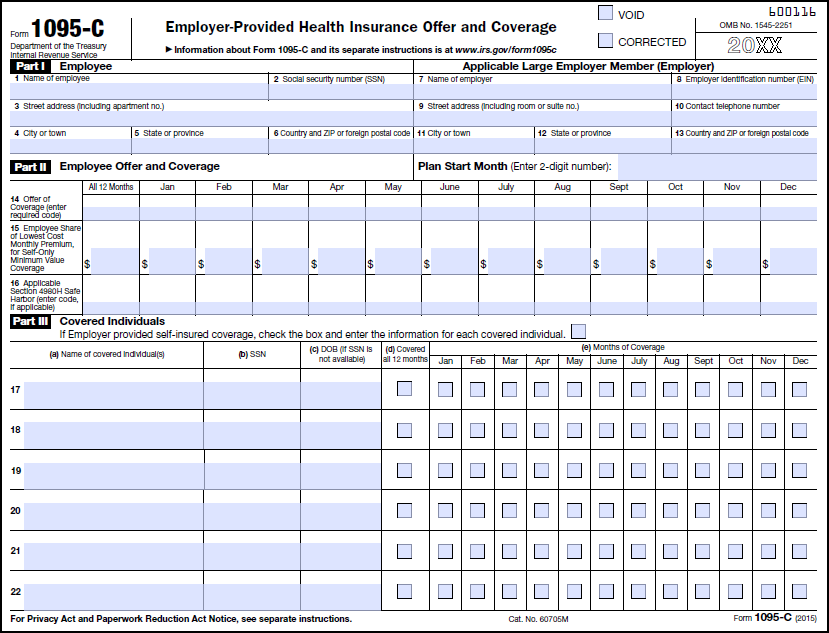

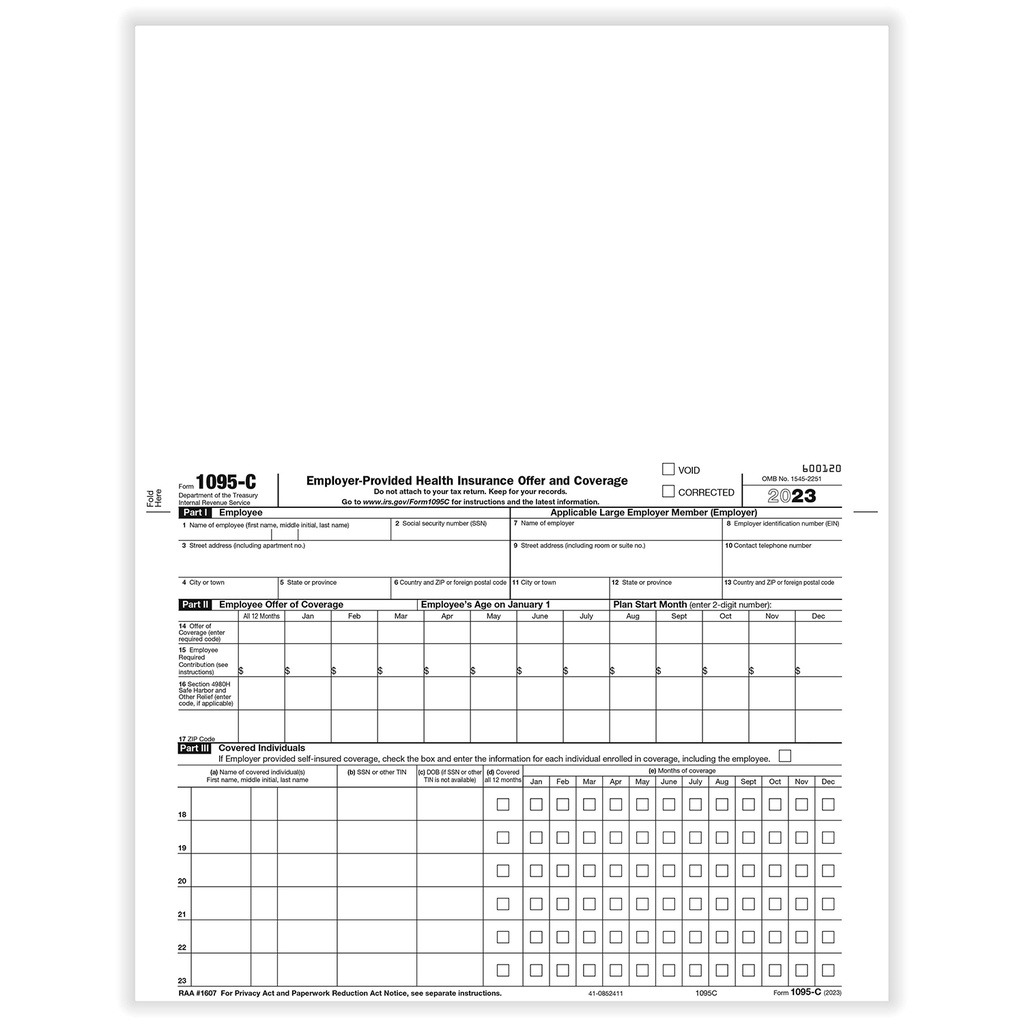

Jul 09, · The 1095 tax form appeared on the scene after the Affordable Care Act passed It helps ensure taxpayers, employers and insurers comply with certain provisions of the act The form includes important information about a taxpayer's health insurance coverage — most people will get at least one of three versions of Form 1095Feb 24, · Forms 1094C and 1095C are used in combination with the IRS automated Affordable Care Act Compliance Validation (ACV) System to determine whether an ALE owes a payment under the Employer Shared Responsibility Provisions under IRC Section 4980HForm 1095C is a reference document that is not completed by the taxpayer It is not filed with a tax return Instead, it should be kept with the taxpayer's records Part I of the form provides

3 Things To Ask About 1095 C Software Hr Technologist

16 Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

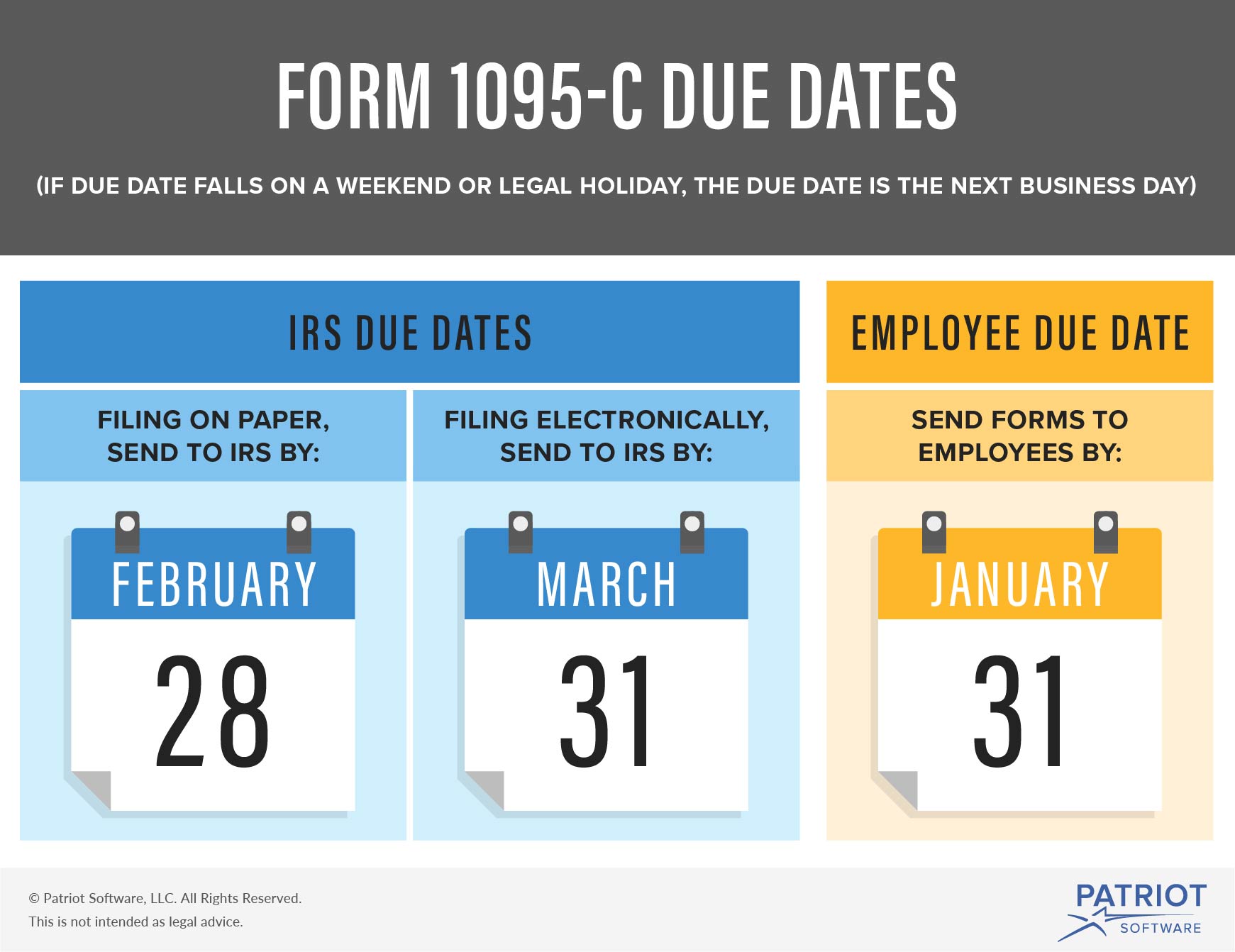

Form 1095C is used to report information about each employee to the IRS and to the employee Forms 1094C and 1095C are used in determining whether an ALE Member owes a payment under the employer shared responsibility provisions under section 4980H Form 1095C is also used in determining the eligibility of employees for the premium tax creditThe due date is end of March So, if you are filing 19 1095C forms, then the due date is March, 31, Can I file on paper?Apr 23, 21 · The 1095 forms verify your health care insurance status for tax purposes 1095A forms debuted in 15, while taxpayers received 1095B or 1095C forms for the first time in 16

Irs Distribution Deadline March 2 21 Aca Gps

Tax Forms 1095 A 1095 B 1095 C Business Benefits Group

Form 1095C is sent to certain employees of applicable large employers Applicable large employers are those with 50 or more fulltime employees Form 1095C contains information about the health coverage offered by your employer in This may include information about whether you enrolled in coverageThe correction form includes instructions for how to provide updated SSNs, which must be in writing For your convenience, forms can be returned to AmeriHealth New Jersey by US mail or by email For more information about the use of the 1095 forms for IRS reporting, please refer to the 1095 Q&A on the IRS websiteMuch like the Form W2 is used to determine whether or not you owe taxes, the IRS will use the information reported from your Form 1095C to determine whether you (or your employer) may have to pay a fine for failing to comply with the Affordable Care Act

1095 C Faqs Mass Gov

Ez1095 Software How To Print Form 1095 C And 1094 C

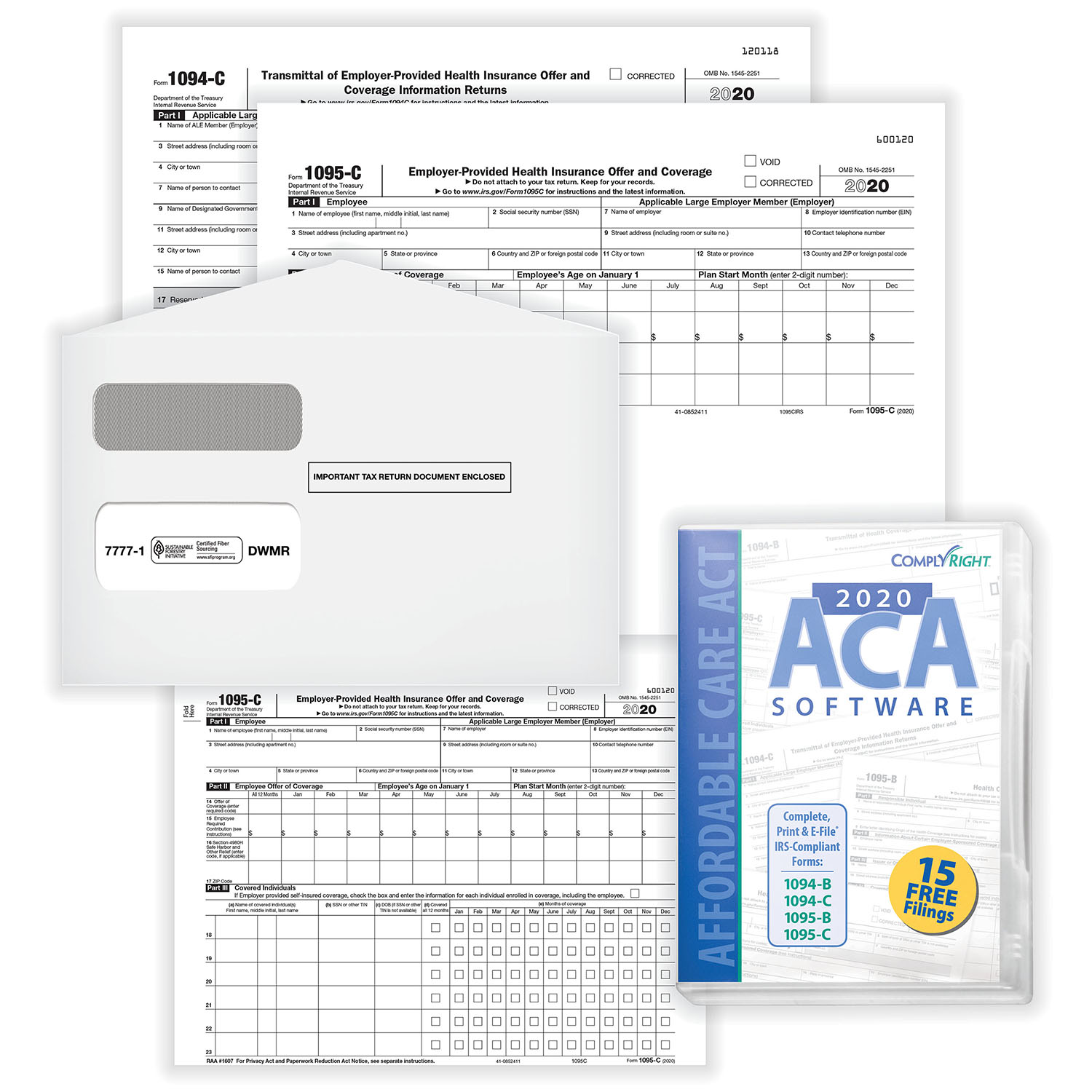

Jan 25, 21 · For tax year 19, we will accept 1095A, 1094B, 1094C, 1095B, and 1095C If the federal government discontinues, substantially alters, or makes unavailable Forms 1095A, 1094B, 1094C, 1095B, or 1095C, New Jersey will deploy similar forms and require they be sent to the State and to New Jersey taxpayersThe IRS Form 1095C is a form that reports to the IRS if you had the minimum essential coverage required under the ACA and also which months of the year you had the qualified coverage Why is it so important to prove I had minimum essential coverage?Jun 06, 19 · You do not have to enter a 1095C in TurboTax You will answer the question in the Health Insurance section that you had health insurance all year and keep a copy of the 1095C with your tax records The insurance company will provide the IRS with the needed information

1095 C Faqs Office Of The Comptroller

Posts Department Of Human Resources Myumbc

Jan 31, · The 1095A is the Health Insurance Marketplace Statement You will receive this IF you purchased your health insurance through the Health Insurance Marketplace The 1095C is the Employer Provided Health Insurance tax form If you receive your health insurance through your employer you will receive thisForm 1095C, Part II, includes information about the coverage, if any, your employer offered to you and your spouse and dependent(s) If you purchased health insurance coverage through the Health Insurance Marketplace and wish to claim the premium tax credit, this information will assist you in determining whether you are eligibleForm 1095C, Part II, includes information about the coverage, if any, your employer offered to you and your spouse and dependent(s) If you purchased health insurance coverage through the Health Insurance Marketplace and wish to claim the premium tax credit, this information will assist you in determining whether you are eligible

1095 C 1094 C Aca Software To Create Print E File Irs Form 1095 C

Form 1095 C Forms Human Resources Vanderbilt University

Jan 26, 21 · Form 1095C is a tax form that provides you with information about employerprovided health insuranceForm 1095C is filed and furnished to any employee of an Applicable Large Employers (ALE) member who is a fulltime employee for one or more months of the calendar ALE members must report that information for all twelve months of the calendar year for each employeePremium tax credits used;

What To Do With Tax Form 1095 C

1095 C Forms Full Sheet With Instructions On Back Discount Tax Forms

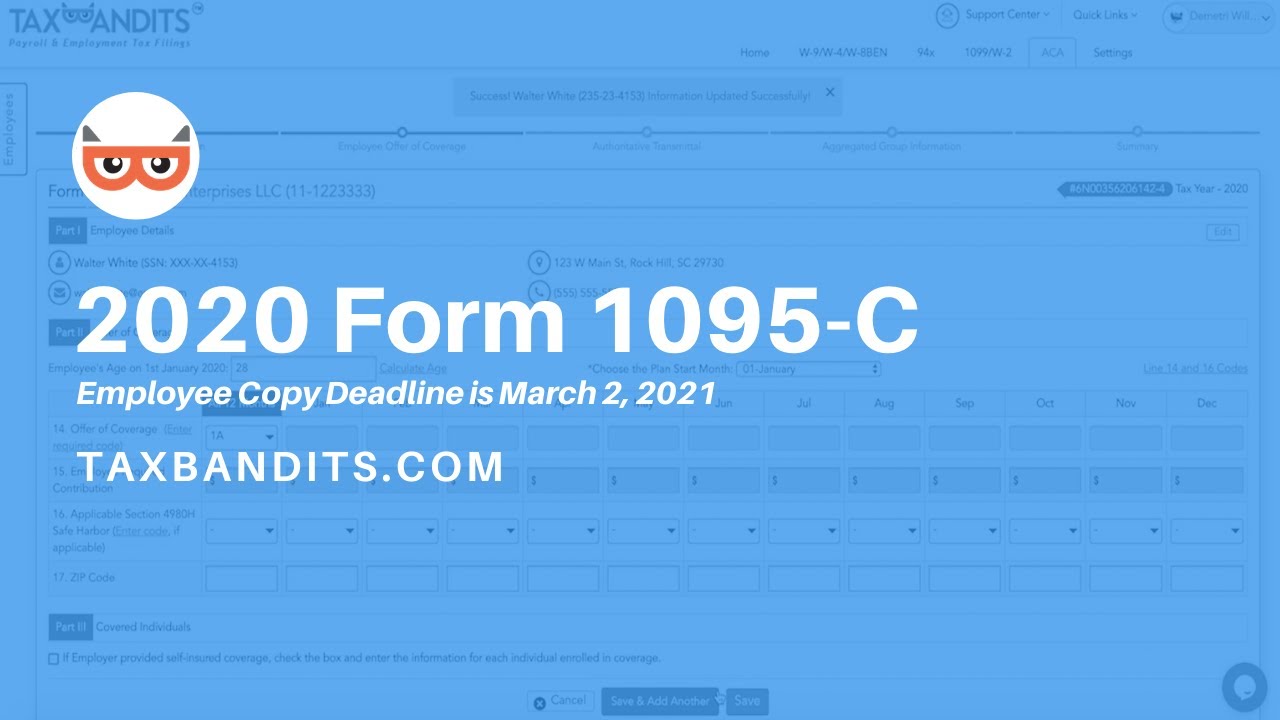

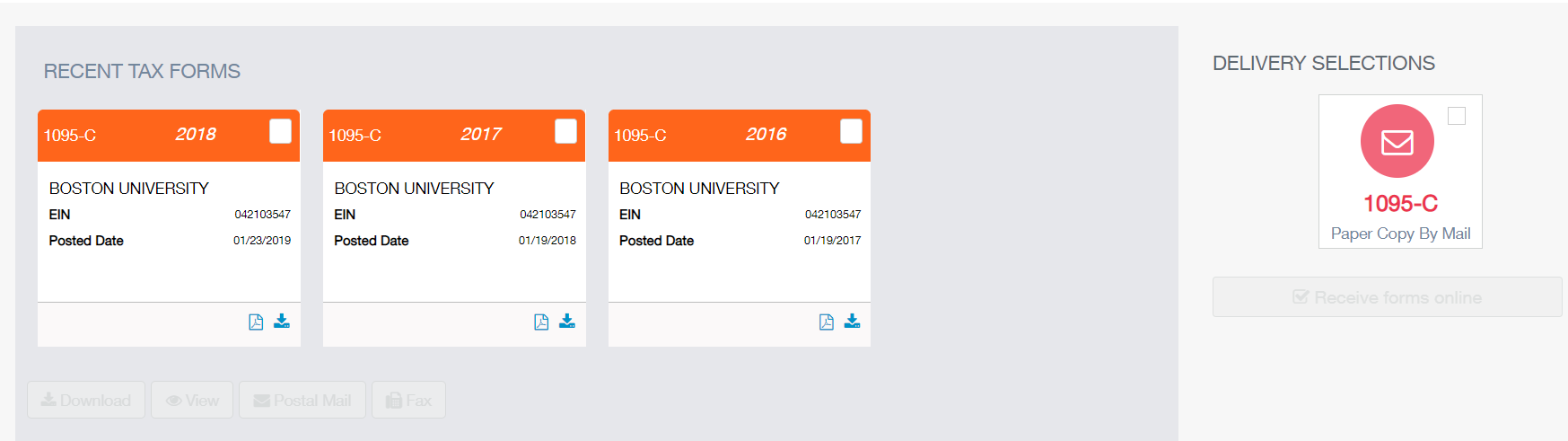

Mar 02, 21 · IRS Form 1095 C Information Form 1095C is an annual statement that employers must provide fulltime employees and those covered by its health insurance plan You can get yours Mailed to your home Please be sure your current mailing address is in Self Service It will be mailed to you by March 2, 21Feb 11, · You do not need to file this form with your tax return Just keep it in your tax records Like Forms 1095A and 1095B, Form 1095C is proof you had health care insurance But, as explained above, this is no longer important because there is no longer a penalty for not having insurance You don't need Form 1095C to file your tax returnForm 1095C Decoder If you were a fulltime employee working 30 or more hours per week or enrolled in healthcare coverage from your employer at any point in , you should receive a Form 1095C If you received a Form 1095C from your employer and you're not sure what the codes mean, check out our 1095C Decoder to learn more

1095 C Submit Your 1095 C Form Onlinefiletaxes Com

Irs Form 1095 C To Be Distributed Hub

Feb 08, 19 · IRS Form 1095C, "EmployerProvided Health Insurance Offer and Coverage," is a document your employer may have sent you this tax season (or will be sending you soon) in addition to your W2About Form 1095C In late February 21, the Health Care Authority, on behalf of your employer or former employer, will mail Forms 1095C and an explanatory insert to Employee, retiree, and continuation coverage subscribers of state agencies, commodity commissions, or higher education institutions enrolled in Uniform Medical Plan for at least one month in 19Jun 08, 19 · Edited If you have a 1095C, a form titled EmployerProvided Health Insurance Offer and Coverage the IRS does NOT need any details from this form You can keep any 1095C forms you get from your employer for your records When you come to the question "Did you have health insurance coverage in 15", simply select "Yes"

Irs 19 Form 1095 C Now Online Stuttgartcitizen Com

1095 C Print Mail s

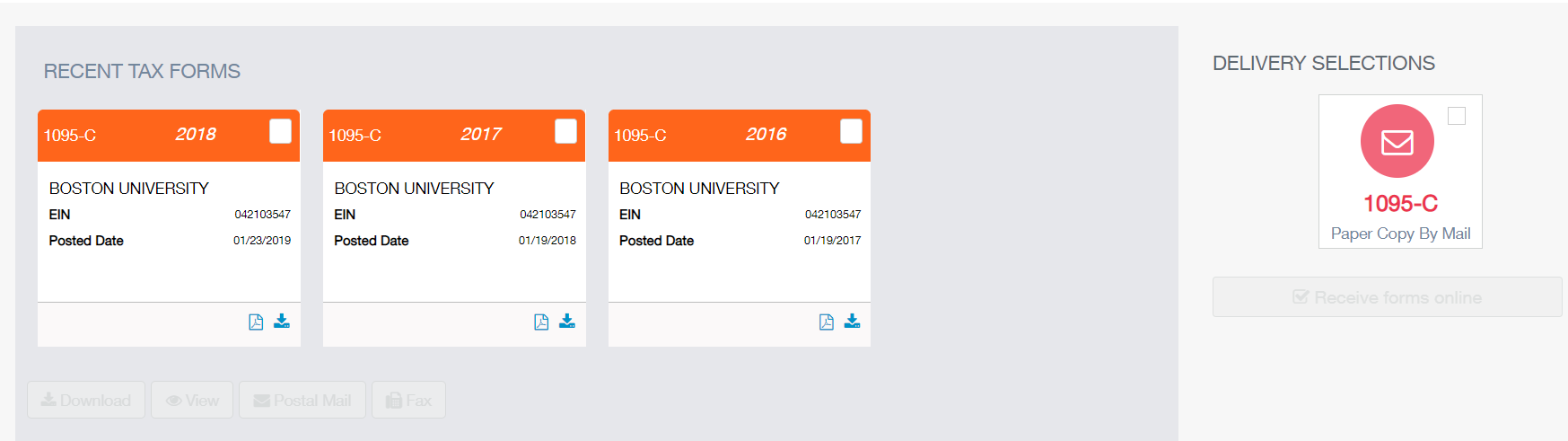

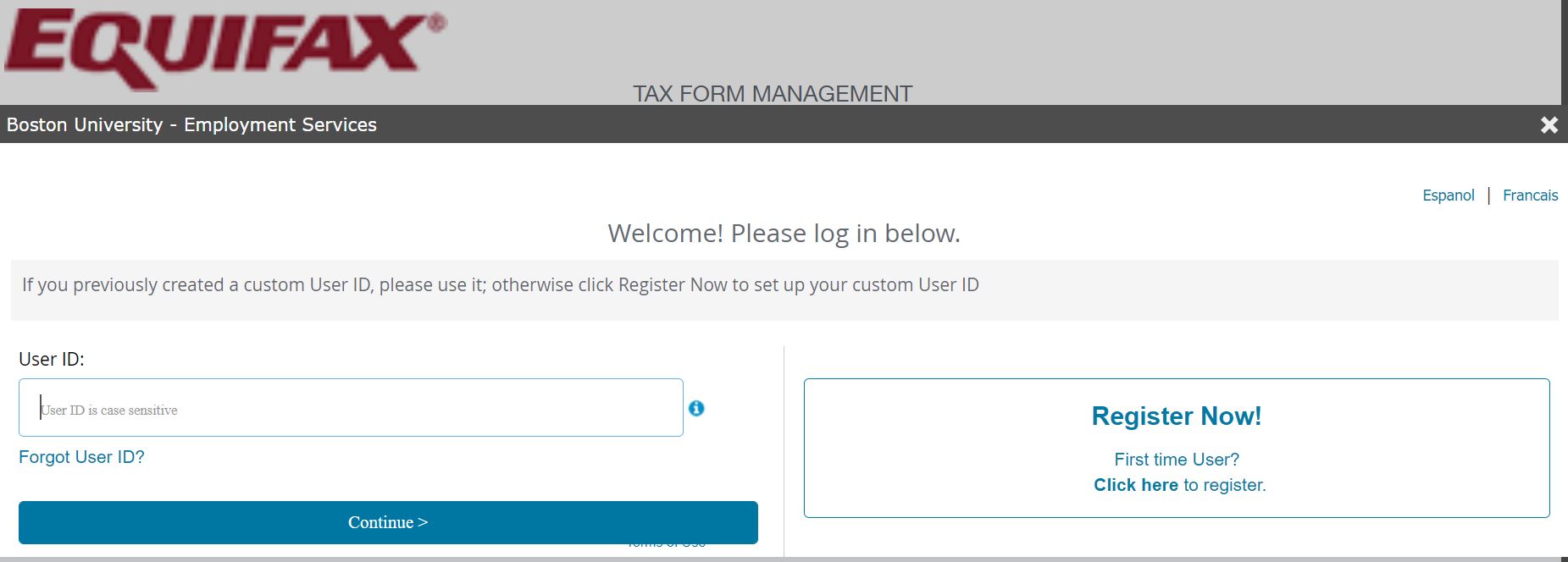

Jan 25, 21 · 1095c Tax forms are available online as of February 15, 21 Beginning 18 tax season and on, employees have the option to obtain their W2 and 1095c documents electronically Obtaining these documents electronically offers many benefits, including the following Secure way to receive documentsThe IRS Form 1095C, also known as the EmployerProvided Health Insurance Offer and Coverage statement, contains important information about medical coverage offered to employees and their dependents by Clemson University While this information is no longer required when filing one's taxes, it should be retained with the employee'sAbout the Form 1095C The Office of the Comptroller will mail paper Forms 1095C (Affordable Care Act) by the end of February Forms 1095B and 1095C should be kept with tax records Do not submit them to the IRS or Massachusetts Department of Revenue

Do I Need My 1095 Form For 19 Solid Health Insurance

Irs Form 1095 A 1095 B And 1095 C Blank Lies On Empty Calendar Stock Photo Picture And Royalty Free Image Image

Form 1095C is not required to be filed with your tax return If you had fullyear coverage for , no action needs to be taken with Form 1095C If you did not have fullyear coverage, use the information on Form 1095C to report the months of coverage you did have, To review all of your health insurance entries From within your TaxActApr 13, 21 · Applicable large employer s – generally those with 50 or more fulltime employees, including fulltime equivalent employees Form 1095C provides information about the health coverage offered by your employer and, in some cases,Jan 07, 21 · 1095C Form 1095C is a health insurance tax form that reports the type of coverage you have, dependents covered by your insurance policy, and the period of coverage for the prior year This form is used to verify on your tax return that you and your dependents have at least minimum qualifying health insurance coverage

What Is The Irs 1095 C Form Miami University

Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

Nov 03, 17 · Form 1095 serves as proof for tax purposes It may also include the information that you'll need to file for health tax credits, which can be a huge help to you Do You Need Form 1095 to Pay Your Taxes?What is the due date to file 1095C forms with NJ?1095C Tax Form In addition to the standard W2 form, employees also receive the federal tax form called a 1095C Duke provides this form annually as part of the requirements of the Affordable Care Act

Alert Irs Extends Due Date For Forms 1095 C And 1095 B

Tax Time Approaches Do You Know Where Your W 2 Or 1095 C Forms Are Montgomery County Public Schools

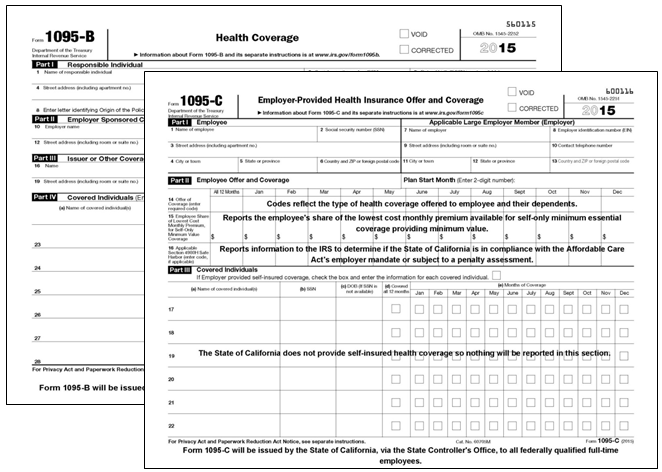

Form 1095C merely describes what coverage was made available to an employee A separate form, the 1095B, provides details about an employee's actual insurance coverage, including who in the worker's family was covered This form is sent outForm 1095C, EmployerProvided Health Insurance Offer and Coverage, reports whether your employer offered you health insurance coverage and information about what coverage was offered to you This form is f or your information only and is not included in your tax return unless you purchased health insurance through the progress in addition to thisJan 18, 15 · **17 IRS Update The IRS has announced an extension for employers and insurers to furnish forms 1095B and 1095C for 17 coverage Employers and insurers now have until March 2nd, 18 This might result in tax payers not having these forms to file taxes before April 15th, 18 Find out more here

Obamacare Tax Forms 1095 B And 1095 C 101 Moneytips

Your 1095 C Obligations Explained

Accurate 1095 C Forms Reporting A Primer Integrity Data

What You Need To Know About Forms 1094 1095 Part 2

New Tax Document For Employees Duke Today

What Does A 1095 C Delay Mean For 1040 Filings Integrity Data

Instructions For Forms 1095 C Taxbandits Youtube

Hr Updates Theu

Affordable Care Act Update New Information About Form 1095 B 1095 C Tax Pro Center Intuit

Form 1095 C Payroll Baylor University

1095 C Tax Form For Gwell

Irs Form 1095 C Uva Hr

An Overview Of 1095 A 1095 B 1095 C Affordable Care Act Forms

Your 1095 C Tax Form For Human Resources

Amazon Com 18 Complyright Ac1095e150 1095 C Employer Provided Health Insurance Offer And Coverage Form And Envelopes Bundle For 50 Employees Office Products

Questions Employees Might Ask About 1095 C Forms Bernieportal

Tax Form Preparation Software 1095 C Software To Create Print And E File Forms 1094 C 1095 C

1095 C Forms Half Sheet With Instructions At Bottom Discount Tax Forms

A Z Important Terms To Know For Forms 1094 1095 C Ts1099 Ts1099

Electing To Receive Your 1095 C And W 2 Forms Electronically 19 Social Security Wage Base Increase

What Is Form 1095 C And Do You Need It To File Your Taxes

Obamacare Tax Forms 1095 B And 1095 C 101 Moneytips

Form 1095 And The Aca Office Of Faculty Staff Benefits Georgetown University

15 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

1095 C Form Official Irs Version Discount Tax Forms

What S New For Tax Year Aca Reporting Air

An Introduction To The Irs Aca Reporting Forms For Employer Reporting

Benefits 1095 C

Changes Coming For 1095 C Form Tango Health Tango Health

The Abcs Of Form 1095

The Irs Releases Final 1094 C 1095 C Forms And Instructions For 18 Tax Year Foster Foster

1095 C Aca Transmittal Of Employer Provided Health Coverage Pressure W 2taxforms Com

Aca 1095 C Basic Concepts

The Instructions For Forms 1094 C And 1095 C Blog Taxbandits

Online Delivery Of W 2 Statement And Form 1095 C

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

15 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

Form 1095 A 1095 B 1095 C And Instructions

What Is Form 1095 C Employer Provided Health Insurance Offer And Coverage Turbotax Tax Tips Videos

Ty Draft Forms 1095 C And 1094 C Released Along With New Form 1095 C Codes Press Posts

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

1095 C Images Stock Photos Vectors Shutterstock

1095 C 18 Public Documents 1099 Pro Wiki

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

Amazon Com Egp Irs Approved Laser 1095 C Employer Provided Health Insurance Tax Form Quantity 100 Office Products

Affordable Care Act Form 1095 C Form And Software Hrdirect

Form 1095 C Guide For Employees Contact Us

Form 1095 C H R Block

Your Tax Forms W 2 And 1095 C One Spirit Blog

Annual Health Care Coverage Statements

17 Tax Year Affordable Care Act Reporting

Obamacare Tax Forms 1095 B And 1095 C 101 Tax Forms Form Tax

Wat Te Doen Met Belastingformulier 1095 C Interessant 21

1095 C Forms Complyright Software Version Discount Tax Forms

1095 C Employer Provided Health Insurance Offer Of Coverage

Irs Form 1095 C Fauquier County Va

1095 C Continuation Forms For Complyright Software Discount Tax Forms

Your 1095 C Tax Form My Com

Hr S Guide To 1095 C Forms Youtube

Irs Form 1095 A 1095 B And 1095 C Blank Lies On Empty Calendar Page Stock Image Image Of Budget Currency

What Is An Irs Form 1095 C Boomtax

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

What Your Clients Need To Know About Form 1095 C Accountingweb

Pressure Seal 1095 C Form Ez Fold Discount Tax Forms

Accurate 1095 C Forms Reporting A Primer Integrity Data

Section 6056 Large Employer Reporting Ts1099 Ts1099

Tax Form 1095 C Employer Provided Health Insurance 1095c Form Center

Employers Are You Unsure Of The Coding On Forms 1094 C And 1095 C The Aca Times

Code Series 2 For Form 1095 C Line 16

Explanation Of 2d On Line 16 Of The Irs 1095 C Form Integrity Data

Sample 1095 C Forms Aca Track Support

Standard Register Laser Tax Forms 1095c Irs Copy 50 Sheets Per Pack Sr Direct

Aca Reporting Faq

Your 1095 C Tax Form For Human Resources

1095 C Form Official Irs Version Zbp Forms